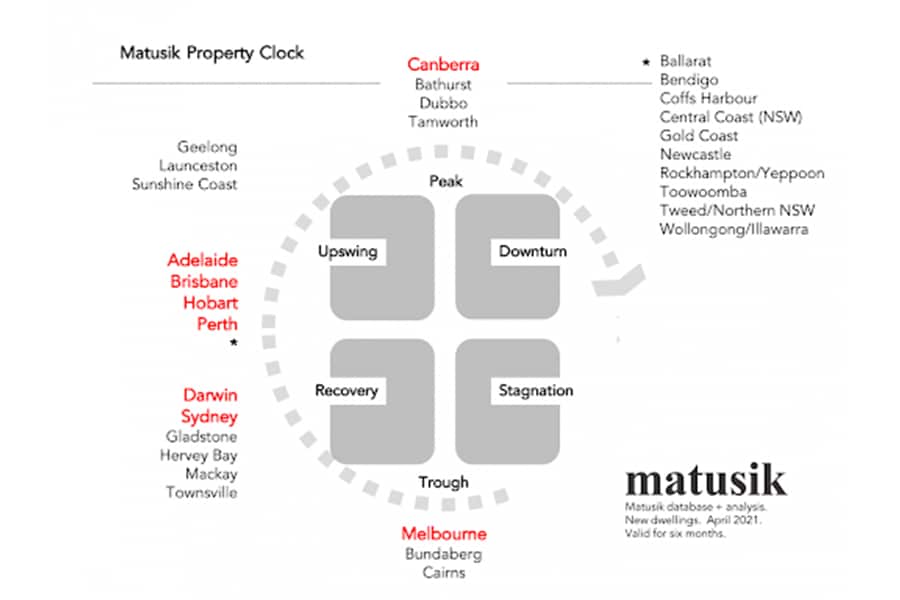

Back in conversation is the ‘property cycle/clock’. Michael Matusik an independent expert to explain what demographic market reviews of property cycles are in our current market. He is an overview of what Acru often discusses with sellers and buyers for a better understanding of the property cycle. (Snapshot as of April 2021)

A property cycle primarily revolves around two factors; supply (the number of properties for sale) and demand (the number of people looking / able to buy a property). If demand exceeds supply, property prices will increase. If new supply comes on the market, from developments or property owners and it exceeds demand, prices will drop. If we look at the national property market you’ll see over the last 10 years that the value of property has continued to increase. However, when you look at the local regions and suburbs there is considerable fluctuation. Why is this? What causes different markets to fluctuate?

As our population grows, demand also increases for properties, both for rental and home owners. As people start to buy and rent properties the value of property slowly increases; the simple forces of supply and demand. At the same time, developers and builders start building new buildings to put on the market, savvy investors and homeowners looking to capitalise on the price rise also list their property for sale. This leads to an oversupply of dwellings which eventually results in slumping home values and rent reductions. There is no exact science when it comes to predicting when a property cycle is going to turn, however there are some factors that can influence the cycle. It’s these factors that economists take into consideration when making forecasts:

What’s happening in my neighbourhood?

Finding out what your local market is doing is critical to help you make smart decisions. Acru Property understands the local real estate in your area and has insights into exactly what is happening in your neighbourhood We can provide you with a local market report that will outline both the micro and wider macro trends affecting the market, along with what is selling and for how much, average time it takes to sell a property and loads more.

Four Phases of a Property Cycle

The Boom

During this phase properties often sell for more than their asking price, as buyer demand outstrips supply. This was what is called a seller’s market. In a market like this, you’ll find developers, investors and savvy home owners will scramble to put their property on the market to benefit from the higher prices which leads to excess supply and an end to the boom phase.

The Downturn

During this phase property’s stay on the market for longer, prices stop growing and in many cases dip. There are a number of causes, it could be a result of oversupply of property due to the activity of builders / developers and sellers in the peak phase. It can also be due to wider economic trends such as tightening of lending criteria. This affects buyers as they may not be granted approval to borrow money or if they are, they’re borrowing capability is reduced and therefore they can’t afford to pay the high prices.

The Stagnation

As the name suggests, this is the period between the peak and the correction and when the market is fairly stable. After a period of stability, people will begin to regain confidence in the market and often investors will jump in before the market increases.

The Upturn

As prices begin to increase, property owners start to jump onto the trend and more properties are listed for sale. Buyers are keen to purchase before the prices rise too much so there is often considerable demand which helps quicken the pace of price rises.

What factors can influence a property cycle?

- Willingness of home loan lenders to lend money

- How much money a buyer can borrow and therefore spend

- Broader economic outlook and unemployment rates

- Local infrastructure projects that can impact demand

- The rate of property price growth / decline

- Vacancy rates for investment properties

- Whether there are suitable properties on the market to suit buyer needs

- Interest rates